Maximize Your Impact

Charitable Donation Accounts

An Innovative Way to “Do Well” by “Doing Good”

Credit Unions are in a constant struggle between driving revenue to the bottom line and making an impact on those around us including our employees, members and community. In other words, we often ask the question:

“How do we do well by doing good?”

The Problem

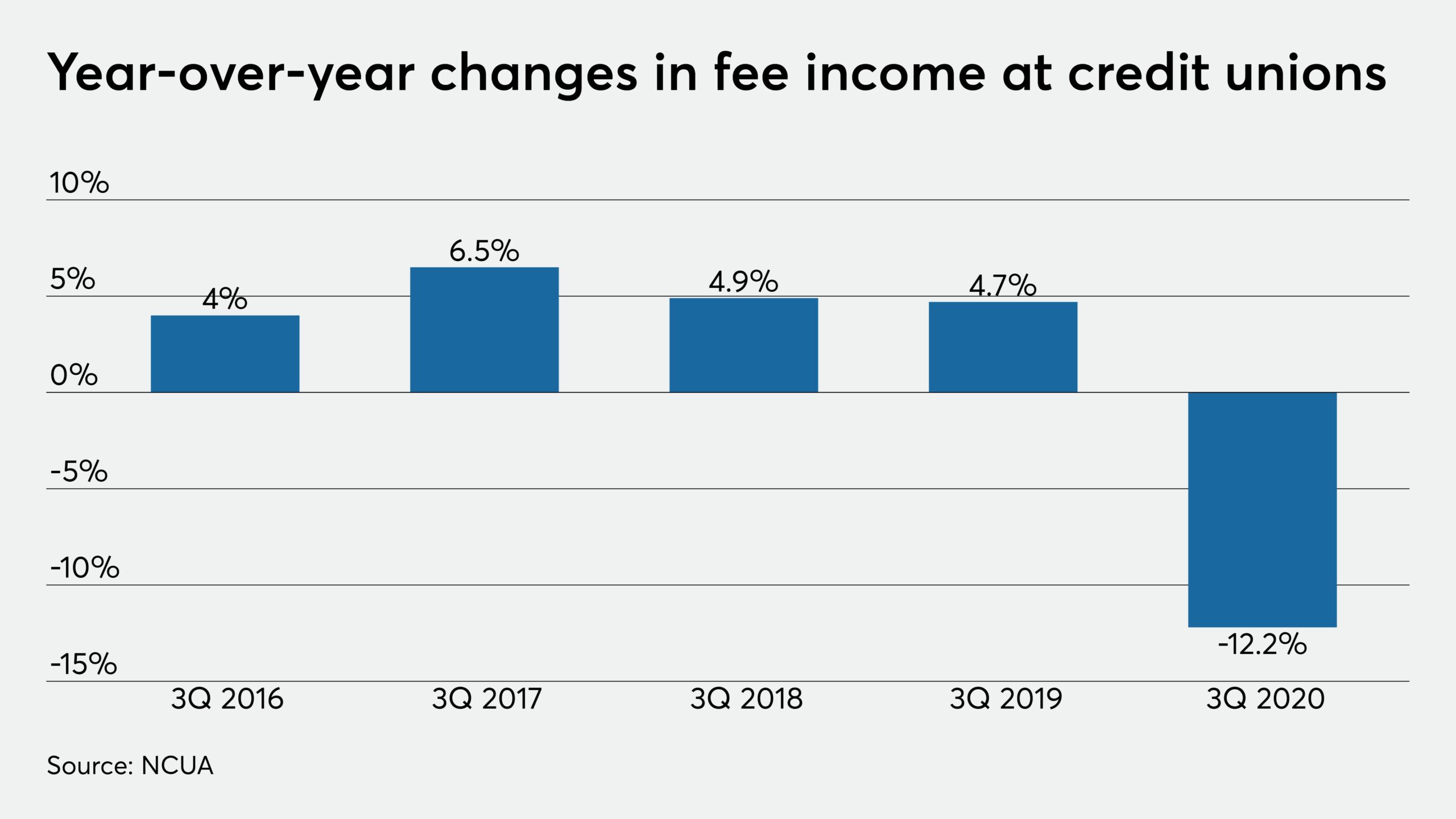

Credit Union Income is Under Pressure

The reality is that Credit Unions are constantly under pressure to innovate their business model in order to address a rapidly changing world. Interest income and fees are shrinking leaving us having to re-evaluate our income strategies. On top of that, many Credit Unions are facing pressure and tougher competition from big banks and fintechs in providing the value proposition that consumers are demanding. Your Credit Union can not afford to do nothing, but at the same time you are wondering what strategies you have that can help offset these pressures.

The Struggle is Real!

We get that there is a constant tension between your responsibility to be a good steward of the bottom line and your desire to make an impact in your community. It feels like if we choose one or the other than we are always in a losing situation.

Either we focus on improving the bottom line or we focus on our impact strategies but they are at odds with each other.

For a growing group of Credit Unions, that struggle is being completely eliminated. We now have proven strategies that allow Credit Unions to actually “Do Well” financially by “Doing Good’ in their communities and we would love to show you how!

“Doing Well by Doing Good”

It’s More Than A Catch Phrase

It’s Possible… We Can Show You How!

The reality is that “Doing Well” by “Doing Good” is not just a catchy slogan and ideal, but it’s a reality for a growing number of Credit Union’s who are implementing the right strategies. We have been developing a practical strategy since 2017 that is proven to do both. A strategy that increase your Credit Union’s income to your bottom line by impacting the lives of your employees, members and community in a sustainable and scalable way.

“We Help Credit Unions

Maximize their impact“

Impact to Your

Bottom Line

Impact The Lives of

Employees & Members

Impact Your Community

For Generations

How it Works (Step by Step)

* Example scenario where your ROI increases from 4% to 10%

Step 1 – Establish a Charitable Donation Account (CDA)

A Charitable Donation Account (CDA) allows your Credit Union to invest in a variety of expanded investment options that traditionally would be deemed impermissible by the NCUA.

With these new investment options being made available to your Credit Union, you can conservatively expect to increase your Return on Investment from 4% to a 10% ROI. We partner with leading Investment Managers to maximize the financial return of your CDA investment.

Step 2 – Establish a Community Impact Fund (CIF)

What makes the Charitable Donation Account possible is the NCUA regulation that requires the Credit Union to donate 51% of the investment returns to a 501(c) Charity of your choice as a way to create Community Impact. The remaining 49% of the proceeds can be used to fund other Credit Union initiatives at your discretion.

In this scenario, the income generated for the Credit Union is nearly double, increasing from $80,000 to $102,000 which is the definition of “Doing Well”. However, what makes this strategy so powerful, is that you were also able to generate $102,000 for a Community Impact Fund that will be used specifically to meet the needs of your employees, members and community, which is the definition of “Doing Good”.

Step 3 – Meet the Needs of YOUR Community

Using a Community Impact Fund (CIF), your Credit Union can further leverage the power of this strategy by directing the 51% of your investment return directly to the needs of your employees, members, and community in the form of an Impact Loan, which is a 0% Interest Loan that helps them save and get out of debt.

A Community Impact Fund solves the biggest problem in your community which is the number of households that are currently ALICE (Asset Limited, Income Constrained but Employed)

The Impact Loan helps employees, members, and your community who are ALICE, meet their needs such as food and clothing, housing, transportation, and medical expenses. In the process of paying back an interest-free loan, they are then incentivized to start building emergency savings at your Credit Union.

Together the CDA and CIF can create a sustainable and scalable form of Community Impact that helps both your bottom line and solves the community’s biggest problems.

Step 4 – Grow Your Income and Your Impact

The end result of this strategy is that your Credit Union has the opportunity to grow both your Income and your Impact. No longer do you have to choose between “Success or Significance” as you have the opportunity to have both!

Our goal is to help Credit Unions leverage their unique characteristics to not only compete with the big banks in Fintechs but to thrive. Together our vision of “Prospering Communities Worldwide” can be a reality and we look forward to working with your team!