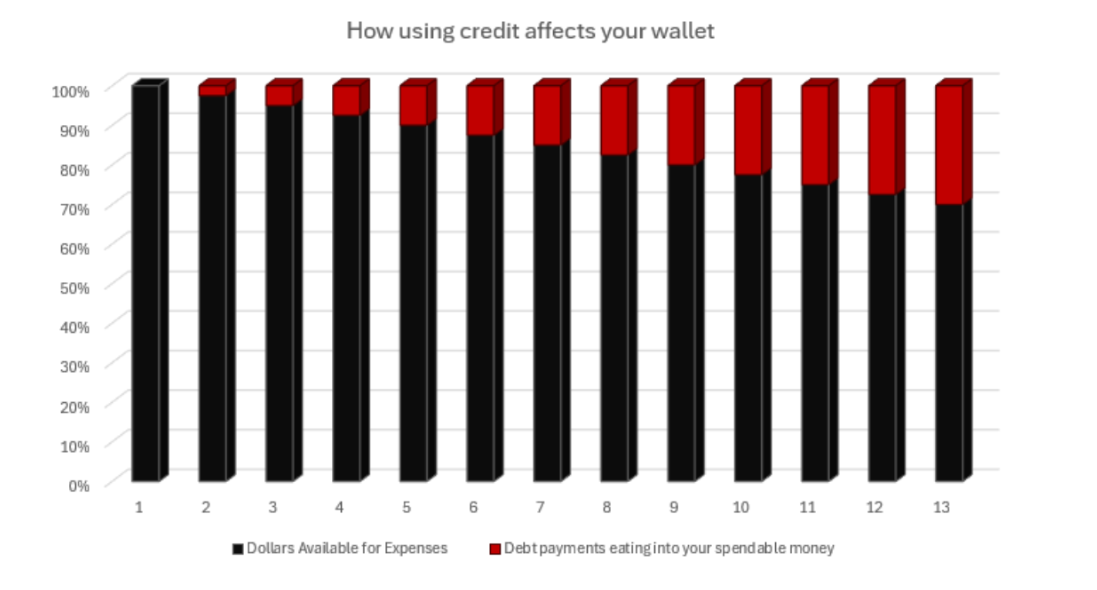

Are you using credit to make ends meet?Experts believe that over 60% of the US population is living paycheck to paycheck and it appears that more and more people are relying on credit to bridge the gap as expenses rise. Credit cards and loans seem easy to get, but how does this path actually affect you? If you do not have any debt, your net paycheck (after taxes and deductions) is available for you to spend as you need or want to spend it. Each time we decide to purchase something before we have the money to buy it outright or to cover expenses (emergency or regular expenses) on credit, we decrease the amount of money we get to choose how to spend the next month. If, when we choose “buy now, pay later” or some other form of credit, we reduce our expenses or increase our income every month to cover the extra payments, then it would not be a problem. Unfortunately that rarely happens, leaving the additional payment to eat into our dollars available for expenses. As you can see in the graph below, adding debt payments (in red), is diverting dollars that we can use to pay for our expenses. |

|

|

|

|

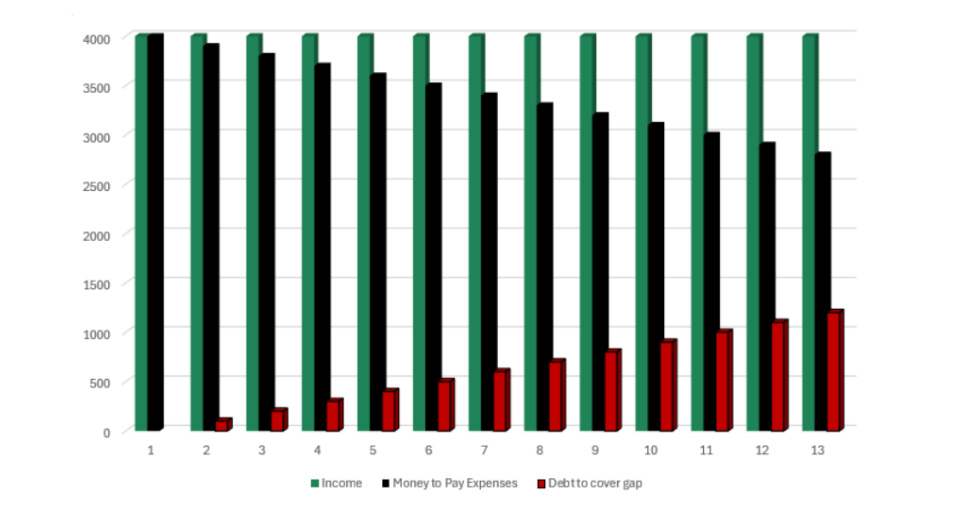

As you can see in month 1, you have 100% of your net income to spend, but you spent more than your net income in the 1st month, which leads to an additional payment in month 2. Your expenses did not decrease, however, and now you have to borrow money to cover the payment and any other shortfall. As you can see, as the months go by the additional payments fuel a need to borrow more and more. So you go from having 100% of your net pay to work with (in month 1) to having only 70% of your income to spend as you need in month 12. This means that 30% of your income is now going directly to pay for your debt. That is known as your debt-to-income ratio. Debt-to-Income Ratio = your monthly debt payments divided by your monthly income In other words, for every $100 you make, $30 is going to pay debts (which in the case of credit cards – is paying for experiences or items you bought in the past). The graph below shows it differently. Your income remains the same (green) and your expenses also remain the same, but now you have less money to pay them (black), which means that you have to borrow the money that you are now paying for your debt (red). The black line is steadily declining while the red is steadily increasing. |

|

|

|

|

This is not sustainable! Eventually the red will overtake the black and there won’t be any more money to pay for the debt payments and the ability to borrow will stop. Using Credit to bridge the gap when we don’t have enough income to pay for our expenses is a dangerous road to travel. If you are on this track, we encourage you to take advantage of a free financial coaching session with Greenpath. Whether you are in this situation because of a tragedy, misfortune, or missteps, there is hope to reverse the course. It isn’t easy, but there are nonprofit organizations that would like to help you if you are willing. |

|

|

No matter what your situation is, you can change it! Remember, you’ve got this. |

|

|

|

|

|